The 3.92% Gold Standard: Are Investors Really Pricing You Out?

There is a loud narrative in America today: institutional investors are buying up the "American Dream" and driving home prices beyond the reach of families (or consumer home buyers), causing a US housing affordability crisis. But when you look at the historical data, the reality is much more nuanced - and perhaps more optimistic for individual buyers.

There is a loud narrative in America today: institutional investors are buying up the "American Dream" and driving home prices beyond the reach of families (or consumer home buyers), causing a US housing affordability crisis. But when you look at the historical data, the reality is much more nuanced - and perhaps more optimistic for individual buyers.

1. The Investor "Boogeyman" vs. Reality

Despite the headlines, large institutional investors aren't a new "invading force". Historically, investors (both small and large institutes) represent 18 - 24% of home purchases. We have seen a recent uptick in these numbers, with investor share climbing toward 30% in the past year, up from a stable 18.5% between 2020 and 2023.

However, it is important to look at the context: this increase is happening within a significantly smaller "pie". Total home sales have dropped to roughly 4 million in the past year - a sharp dip from the 6 million+ annual pace during the pandemic and the 5 million average in the years prior.

My read is that today’s challenging environment of higher interest rates has sidelined many traditional buyers. We can see this clearly in the cash purchase rate: as mortgage rates spiked, the share of homes bought with all-cash (vs. financed) surged to 32 - 35% between 2023 and 2024. This "cash-is-king" environment naturally favored investors and wealthy buyers. But the market is finally starting to ease. In the past quarter, the cash purchase rate dipped back down to ~30%. While still higher than the 27.5% pre-pandemic average, it is a signal that the market is starting to reopen for traditional homeowners.

This shift suggests that the recent investor dominance was a result of a constrained environment, not a permanent takeover. While this "shrinking pie" isn't great for the non-investor community in the short term, it is likely a temporal shift. Even with this recent volatility, the vast majority of home sales - and the decades of historical data that follow - remain dominated by homeowners.

OK, so most of the historical US house sales data is dominated by non-investors. Let's assess the data more closely and see if we can draw some useful learnings about home value growth:

2. The "Gold Standard" of Real Estate Returns

The US Single Family home is a quite a sizable market, with 85 million houses. When we look at the historical sales data, we can see that ~5 million single-family homes are sold in the US every year , 85% of which are existing home resales. This means we have a huge amount of historical data (5M records per year!), and this data set mostly represents how existing home value holds.

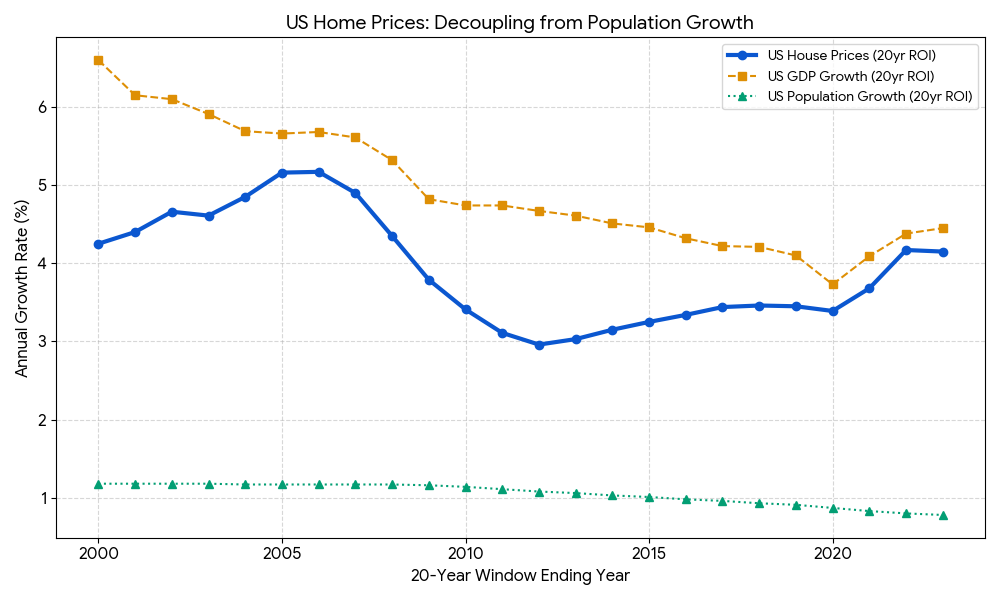

The consistency of the US housing market is staggering. Since World War II, prices have only dropped year-over-year in 7 of the last 70 years, in went up year-over-year in the remaining 63 years (90%). To find the "truth" for a long-term investor, I analyzed a 20-year rolling window of the Federal Reserve's House Price Index from 1980 to 2024. By “20-year rolling window”, I mean - looking at the annual value increase between 1980 - 1999, 1981 - 2000, 1982 - 2001, etc.

The Findings:

Average Annual ROI: The average annual value growth of these 20-year windows is 3.92%. I call this the Gold Standard for long-term planning.

The Floor: Even the "worst" 20-year period (1993–2012), which included the subprime crisis, yielded a positive 2.92% annual return.

The Ceiling: The highest 20-year window reached 5.17% annual growth (the 1987–2006 window, right before the crash).

At the end of the day, a 3.92% average annual growth is a remarkably consistent anchor for long-term wealth - especially when you consider it’s just the "top-line" value. When you layer on rental income, tax benefits, and the power of leverage, that return begins to look much more like 9 - 10% (a math deep-dive I’ll save for a future post).

But even with a "Gold Standard" in hand, a bigger question remains: Why? What is actually pushing these prices up decade after decade, and is it sustainable?

3. The Growth Gap: Why Slowing Population Doesn't Mean Slowing Prices

I went into this research with a fear. My intuition was that house price growth should correlate directly with population growth - the simple logic being, "the more people we have, the more houses we need". But as I looked at the data, the reality of the US population trend was anything but promising.

This led me to a scary question: If house prices rely on population growth, and that growth is slowing to a crawl, is the housing market destined to collapse?

The surprising answer is no. There is almost zero correlation between population growth trends and house price appreciation. While population growth has trended down since the 90s (from ~1.4% to <0.80%), house prices have continued their steady climb.

So, what does it correlate with? GDP.

The Correlation: House prices track the growth of the US economy (Gross Domestic Product). As we produce more value as a nation, that wealth is captured in our land. Between 1980 and 2024, US GDP grew almost every year, and even more consistency when looking at the 20-year windows, averaging a 4.95% annual growth for 20-year window - and very much aligned with the steady climb of real estate.

What to look for in this graph: Notice how the green line (Population) is sliding toward zero, while the thick blue line (House Prices) stays tethered to the orange line (GDP). This visually proves that as long as the American economy produces more value, home prices have a foundation to rise, regardless of how many people are in the country.

Given the historical link between US economic growth and real estate appreciation, it is a safe assumption that real estate values will continue to rise as long as the US economy maintains its growth trajectory.

4. The "Step-Up" Secret: Why Supply Stays Low

Market liquidity is another factor maintaining the resilience of prices. A key reason for high prices is the Step-Up in Basis rule, which enables heirs to inherit a property at its present market value. This effectively eliminates the capital gains tax liability on the appreciation that occurred during the parents' ownership.

This creates a powerful incentive for older generations to hold onto their assets. Instead of downsizing, many homeowners stay in their family homes to protect that tax-free wealth transfer for their children. While this reduces the supply of homes for young families, it has been a cornerstone of how America builds and keeps wealth since 1921.

The Bottom Line

I realized I can’t change the tax code or stop the slow-down of population growth. But I can help people understand these "rules of the game".

Real estate isn't going up because of a few big investors; it’s going up because the US economy is growing and our tax laws reward long-term ownership.

I expect that the market is going to move upward with or without institutional investors.

The best way to fight back against the "wealth gap" is to get on the scoreboard.

References:

US House Price Index: https://fred.stlouisfed.org/series/USSTHPIֿ

US Population Growth Rate: https://www.macrotrends.net/global-metrics/countries/usa/united-states/population-growth-rate

US GDP: https://www.macrotrends.net/global-metrics/countries/usa/united-states/gdp-gross-domestic-product

Investor owned homes: https://nationalmortgageprofessional.com/news/small-investors-dominate-single-family-home-market

Cash purchase rate: https://fred.stlouisfed.org/series/HSTFC

Have questions or want to dive deeper into the data? Reach out at info@mylongterm.com