The Value of Real Estate Investment

Real estate is more than just sticks and bricks; it is a financial engine. While the concepts are timeless, the execution requires modern analysis. On this page, I break down the fundamental logic of why real estate remains the most reliable vehicle for generational wealth - and how we use data to ensure your specific journey stays on track.

Why Real Estate? The Numbers.

Historically, U.S. residential real estate delivers an average +10% annual return. This comes from two powerful engines:

Appreciation (~4%): Property values have grown steadily for over 60 years.

Rental Yield (5–8%): Reliable monthly cash flow from your tenants.

The Result: S&P 500-level returns, but with significantly less volatility.

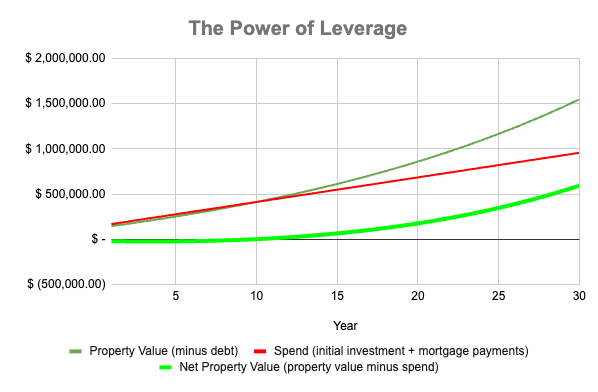

The Power of Leverage

Real estate is the only asset where the bank helps you build wealth.

Own More for Less: A $140k investment (25% down) controls a $500k asset.

Amplified Growth: You gain appreciation on the full $500k, not just your cash.

Cash Without Selling: Refinance to pull out equity tax-free without losing your asset.

The Power of Leverage - $140K initial investment becomes a $592K Net property value after 30 years (excluding rental income value!)

Model assumes $500K initial property value, 25% downpayment ($125K) + $15K closing cost, with 30yr fixed mortgage at 6% interest, and 3.9% yearly property value increaseBuilt-In Tax Efficiency

Keep more of what you earn through government-backed incentives:

Depreciation: Offset your rental income to lower your tax bill.

1031 Exchange: Swap properties to grow your portfolio while deferring taxes.

Legacy Wealth: Pass assets to heirs with a "stepped-up basis," potentially eliminating capital gains tax entirely.

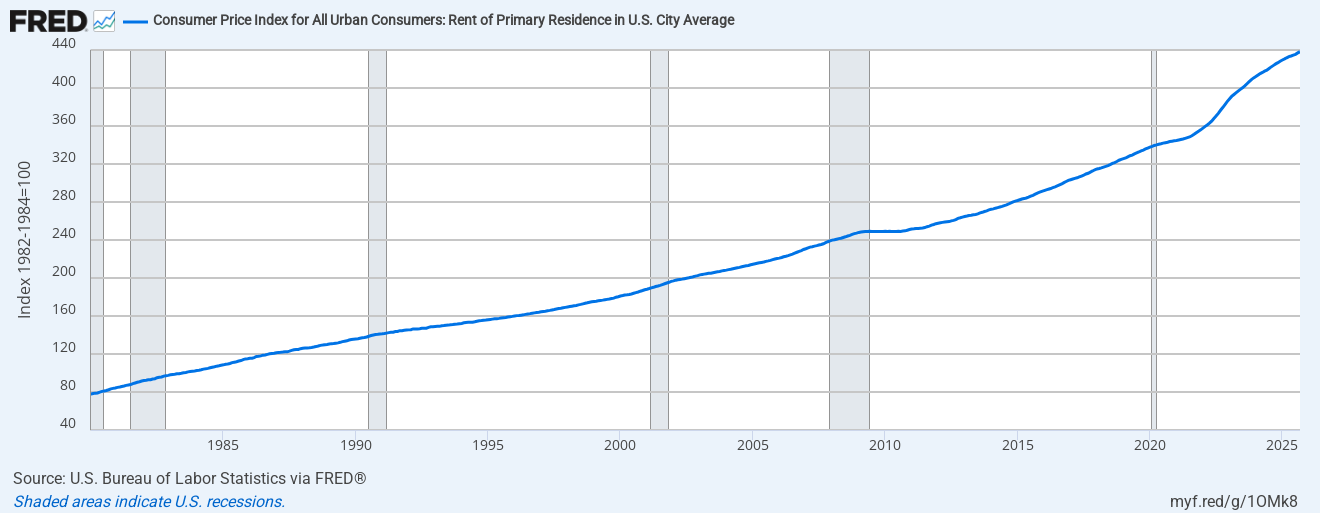

An Inflation-Proof Income

While the cost of living goes up, so does your profit.

Fixed Costs: Your mortgage payment stays the same for 30 years.

Rising Income: Rents have increased year-over-year for 50+ years.

The Margin: As inflation rises, the gap between your fixed costs and your rising rent grows - putting more cash in your pocket.

Consumer Price Index - Rent of Primary Residence in US (1980 - 2025)

Source: Federal Reserve Bank of Saint LouisHonest Pros & Cons

Real estate isn't "get rich quick" - it’s "get wealthy for sure."

Requires Expertise - I will provide you the data and vetted providers.

Not 100% Passive - I will help you build systems that minimize your "work time."

Less Liquid - I will help you stay the course, and help you consider your value extraction options.

The Preferred Choice

There’s a reason Americans consistently rank Real Estate as the #1 long-term investment (Gallup). It’s tangible, stable, and proven.

References:

US Housing Sales Data: https://fred.stlouisfed.org/series/USSTHPI

US Housing Rent Data: https://fred.stlouisfed.org/series/CUUR0000SEHA#0

Gross Rental Return: https://www.nber.org/system/files/working_papers/w21804/w21804.pdf

Gallup Survey: https://news.gallup.com/poll/660161/stocks-fall-gold-rises-real-estate-best-investment.aspx