Investment Case:

Single-Family Home in Knoxville, TN - estimated 20% IRR / x3.68 MOIC since purchased

In late 2018, a ~3,100 sq. ft. single-family residence (4BR/3BA) was acquired in Knoxville, TN (zip code 37922), following a strategic pivot toward recession-resilient markets. Driven by risk-mitigation objectives reminiscent of the 2008 financial crisis, the selection targeted a region characterized by historical stability and steady value retention.

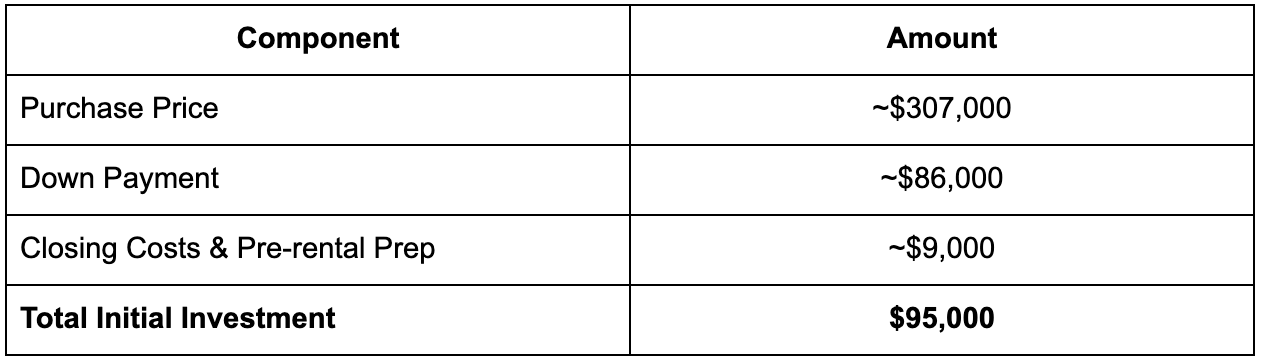

The acquisition was further supported by localized due diligence, leveraging regional institutional data and neighborhood-specific insights to validate the quality of the school districts and long-term growth potential.Initial Investment Details:

It took a few months to secure a tenant, who moved in during early 2019 with a starting monthly lease of $2,100.

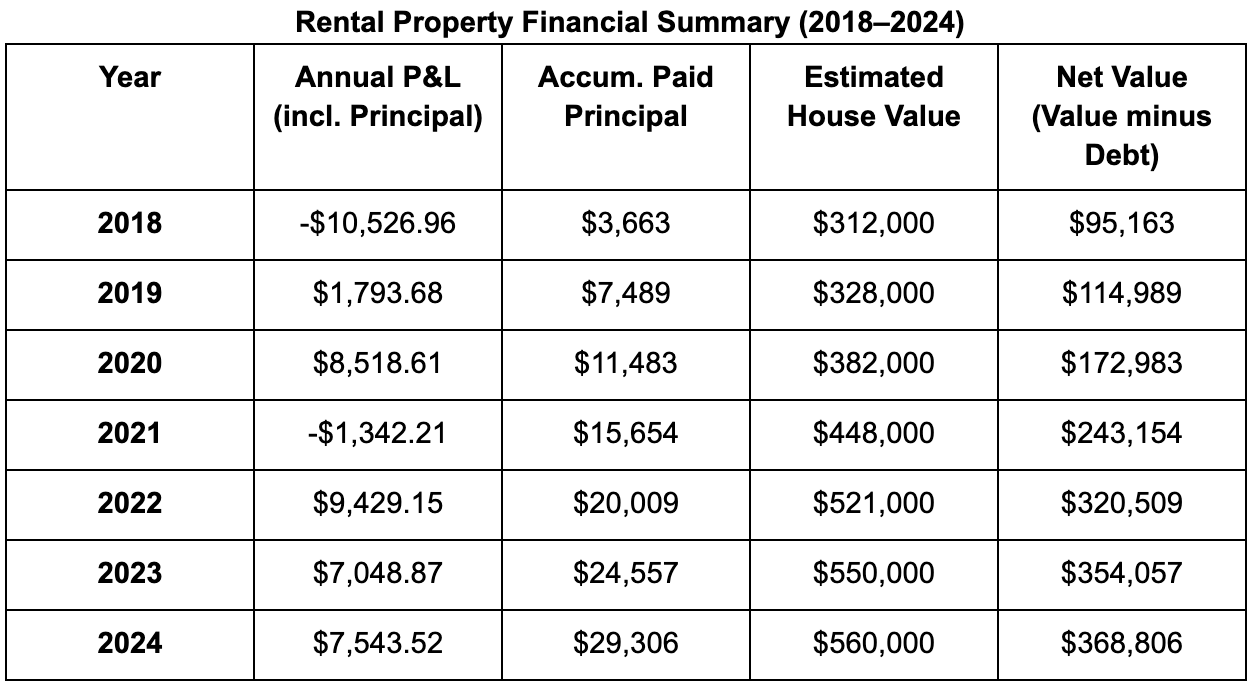

The performance of this investment is analyzed across two main areas: Rental Profit & Loss (P&L) and House Value Appreciation:

1. Rental P&L

The rental property's cash flow was negative in 2018 due to initial vacancy, became slightly positive in 2019, and remained relatively stable thereafter (with higher vacancy in 2021 being an exception).

Total Rent Cashflow (2018-2024): $22,000

Accumulated Principal Payments (2018-2024): $29,000

Total Rental P&L Value: $51,000

While the general policy prioritizes rental stability for existing tenants, two instances of turnover occurred during this period, facilitating market-rate adjustments and a substantial increase in rental revenue:

Rent: $2,100/month (2018) to $2,800/month (2024)

Annual Rent Increase (CAGR): 4.9%

2. House Value Appreciation

Although the house has not been sold, market estimates (such as Zillow) suggest a significant increase in value:

Purchase Price (2018): $307,000

Estimated Value (Late 2024): ~$560,000

Average Annual Appreciation (CAGR): ~8.9%

The realized appreciation significantly exceeded original projections. Initial forecasts modeled an average annual increase of 3.6%, targeting a 2024 valuation of $386,000; however, actual market performance surpassed these figures. This accelerated growth appears primarily driven by a surge in regional market demand following the COVID-19 pandemic.

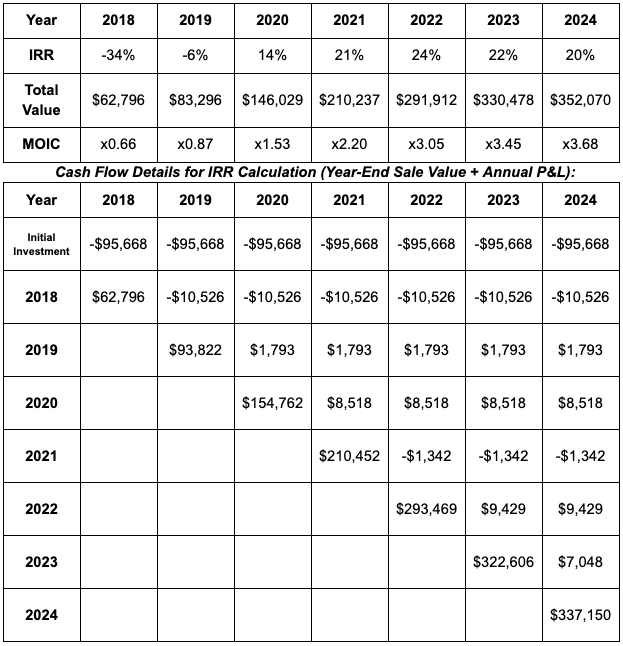

Bringing 1+2 together

Bringing the rental and appreciation figures together, the investment yielded an exceptional average annual Internal Rate of Return (IRR) of 20% between 2018 and 2024.

Or, initial investment of $95,000 in 2018 turns to an estimated value of ~$337,000 in 2024.

Analysis Based on Original Conservative Projections:

Even if the actual appreciation and rent increases had aligned with the original conservative projections:

Projected Appreciation: 3.6%/year (House Value: $386K in 2024)

Projected Rent Increase: 2.8%/year (Rent: $2,435/month in 2024)

The investment would still have generated a strong average annual IRR of 9% between 2018 and 2024.

More detailed analysis

The financial performance and value growth of the rental property from 2018 to 2024 are summarized below, including both annual profitability and the cumulative Internal Rate of Return (IRR):

This table shows the IRR achieved if the property were sold at estimated value (minus cost of sale) at the end of each respective year, based on a constant initial investment of -$95,668:

Check out another case here.